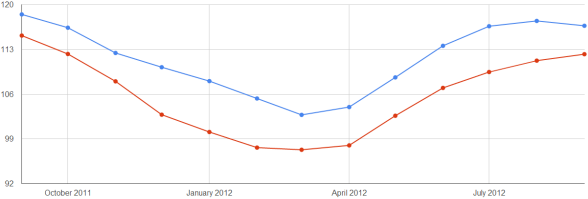

Chicago’s Case-Shiller Index for September fell 0.7% from August. This was after 4 months of increases. The increase from July to August was 0.7%. So it’s back to its July level and where it was in September 2001.

The index is down 1.5% from September 2011. The Case-Shiller Index for Chicago is based on resales of houses in the Chicago Metro Area. It’s published with a 2 month lag.

The Chicago Case-Shiller Condominium Index for September rose 0.9% from August. It rose 1.6% from July to August. The condo index is down 2.5% from September 2011. It’s back to its October 2011 and April 2001 levels.

WHAT THIS MEANS FOR BUYERS

It’s still a buyer’s market, but due to significantly lower inventories you don’t have nearly the choices that you had a year ago. However, the market may be forming a bottom which is a good time to buy! For more evidence that a bottom is forming at least in the Chicago downtown condo market, see Crain’s Chicago Business article, “Why ‘small ball’ is a good sign in condo development“.

WHAT THIS MEANS FOR SELLERS

Four months of increases for the spring and summer markets don’t mean that we’re back to a seller’s market. Such increases have been typical even during the past few down years. I see this more as evidence that the Chicago real estate market may be forming a bottom. I don’t recommend selling unless

1. you really need to

or

2. you want to move up to a more expensive home (It’s probably come down more in value in the past few years than your current home.)

As always, if your home is priced right when it goes on market, it will sell in a reasonable amount of time.

ABOUT THE CHICAGO CASE-SHILLER INDICES

Keep in mind that the Chicago Case-Shiller Indices are for the entire Chicago Metro Area. Markets do vary by location, price range and housing types. For more market statistics see Chicago Real Estate Market. For more information on the indices see S&P/Case-Shiller Home Price Indices.

Fran Bailey specializes in downtown Chicago, Lincoln Park and Lake View condos, co-op apartments and houses. She has shared home buying and selling advice since 2006 and written about over 130 Chicago high rises. To schedule showings for any listings, get a

Fran Bailey specializes in downtown Chicago, Lincoln Park and Lake View condos, co-op apartments and houses. She has shared home buying and selling advice since 2006 and written about over 130 Chicago high rises. To schedule showings for any listings, get a